|

Scorecard

SECURE CLOUD-BASED CHANNEL | EASY TO USE | CUSTOMIZED INPUTS | REAL TIME RESULTS

|

|

|

Our new Analytic Platform puts the power of FinPro’s dashboards and what-if analytical capabilities in your hands so you can use these dashboards anytime you choose using your Bank’s data.

BENEFITS OF THE SCORECARD

|

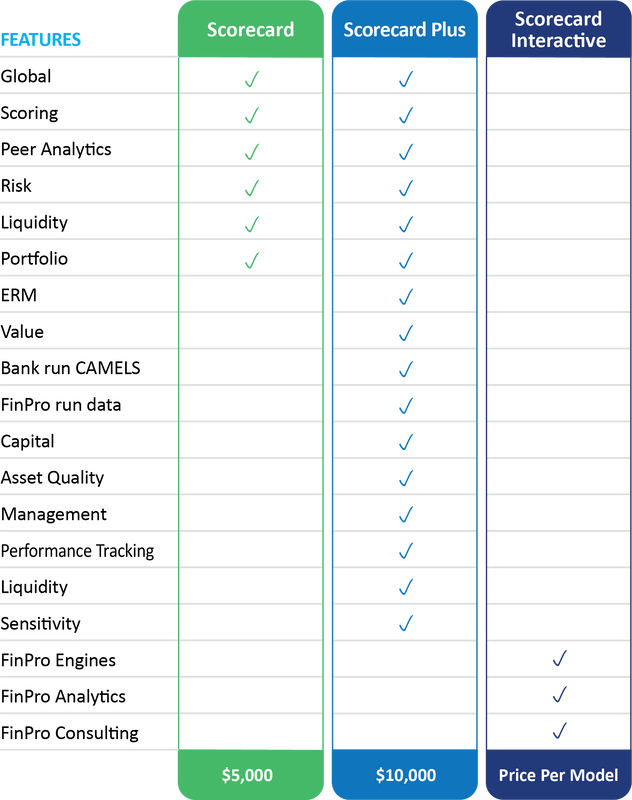

SCORECARD PRICING

|

FINPRO’S ANALYTICS & POWERFUL ENGINES

The details of our dashboards are highlighted below:

The details of our dashboards are highlighted below:

- Peer/Data Screener Dashboard: Compares key metrics with peer group medians and individual peer banks.

- Scoring & Risk Dashboard: Identifies the critical issues and allows the Bank to focus on the key issues. It can also be utilized to underwrite banks for sub debt due diligence and for third-party analysis relative to counter party risk.

- Liquidity Dashboard: Liquidity sequence is determined when the funding becomes available in the master account. Shift is from categorizations not tied to true funding availability to time sequenced liquidity.

- Portfolio Dashboard: Provides data on delinquencies, non accruals, charge-offs and recoveries by loan category.

- Performance Tracking: Provides a variance to the Bank’s strategic plan on a quarterly basis. Variances will be presented for the balance sheet, income statement, and key ratios in a CAMELS format.

- ERM: Allows Banks to identify, measure, monitor & control risk throughout the organization using a detailed ERM framework. Scores the highest risk areas based on thresholds. Allows management to document the inherent risk, risk management processes & procedures, and the resulting residual risk for all major areas of the Bank. Also includes historic and future performance overlayed on the Bank’s custom risk thresholds.

- Value: Allows Boards to set a specific internal rate of return (stock price appreciation + cash dividend yield) to determine the required future performance needs.

- Capital: Allows users to conduct a risk assessed capital analysis of the Bank based on a capital requirement methodology for each identified risk specific to the Bank. Also includes capital stress testing.

- Asset Quality: Provides thresholds for qualitative factors for ACL, a review of the Bank’s ACL to industry expectations, and a review of key asset quality ratios.

- Management: Provides corporate governance grids for directors on expertise & training, including a tool to conduct annual board assessments through a detailed questionnaire. Aligns board oversight regarding bank functional areas reporting to the Board and its committee structure.

- Liquidity: Provides point in time liquidity measures from detailed client input. Includes forward looking cash flow liquidity stress testing as well as time series analytics.

- Sensitivity: Allows management to analyze the IRR impact of detailed strategic initiatives and the resulting impact on EVE and net interest income sensitivity under multiple rate scenarios.